Table of Content

Home insurance—an insurance policy that protects the owner from accidents that may happen to their real estate properties. Home insurance can also contain personal liability coverage, which protects against lawsuits involving injuries that occur on and off the property. The cost of home insurance varies according to factors such as location, condition of the property, and the coverage amount. Finder.com is an independent comparison platform and information service that aims to provide you with information to help you make better decisions.

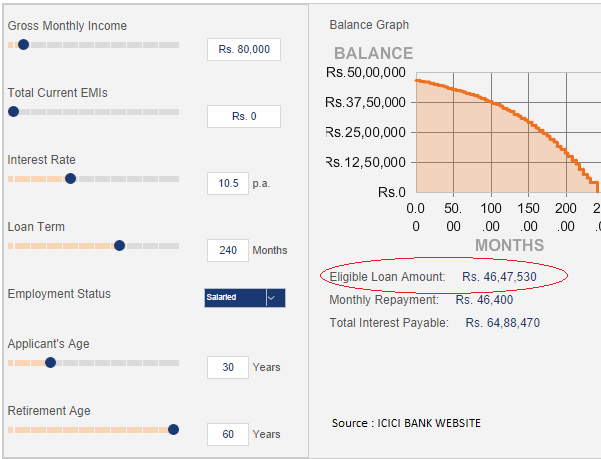

Many lenders estimate the most expensive home that a person can afford as 28% of one's income. Buying with bad creditIf you have bad credit and fear you'll be denied for a mortgage, don't worry. You may still be able to get a loan with a low credit score.

Health Calculators

However, these limits can be higher under certain circumstances. Home loans with variable rates like adjustable-rate mortgages and home equity line of credit loans are indirectly tied to the federal funds rate. When the federal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage.

Debt-to-income calculatorYour debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you're in the right range. Capital locked up in the house—Money put into the house is cash that the borrower cannot spend elsewhere. This may ultimately force a borrower to take out an additional loan if an unexpected need for cash arises.

Jumbo loans

There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. Make sure to add taxes, insurance, and home maintenance to determine if you can afford the house. Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time.

Mortgages are how most people are able to own homes in the U.S. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price.

How much is a mortgage point?

However, there are some lenders that prohibit overpayments, and they will levy large early repayment charges if overpayments are made. Therefore, before you make any overpayment on your mortgage you should always check with your mortgage provider. One of the main factors when deciding whether to take out a mortgage is the size of the mortgage repayments. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

For example, paying off a mortgage with a 4% interest rate when a person could potentially make 10% or more by instead investing that money can be a significant opportunity cost. Loan term—the amount of time over which the loan must be repaid in full. Most fixed-rate mortgages are for 15, 20, or 30-year terms.

Mortgages Direct provides an independent mortgage quotes and advice service. When you submit this form you will be contacted by a regulated mortgage adviser to discuss your options. Streamline your mortgage from quote to final payment — all from your computer or phone. We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision. See how much you'd pay in total interest based on the interest rate.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Fill out the form and click on “Calculate” to see yourestimated monthly payment.

Any discount points purchased will be listed on the Loan Estimate. Learn more about the line items in our calculator to determine your ideal housing budget. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing . In a mortgage, this amounts to the purchase price minus any down payment. The maximum loan amount one can borrow normally correlates with household income or affordability. To estimate an affordable amount, please use our House Affordability Calculator.

What's the monthly payment of a 30 year $300,000 home loan? Most amortization calculators will also give you the option to generate an amortization schedule. Think of an amortization schedule like a detailed payment plan for your loan. It lists each payment and breakdowns how much of that payment is interest and how much goes toward the principal. It will also track the remaining principal and how much total interest you'll end up paying. Be aware that amortization schedules are somewhat simplified as they don't account for taxes, fees, extra payments, refinancing or changes in the interest rate.

No comments:

Post a Comment